Extension of the investment services license

At Equito we have successfully extended our existing MiFID II license. The extended license allows us to offer asset management services, investment advice and publish investment research.

Every successful investor follows a certain investment strategy. An investment strategy helps to narrow down the selection of potential investments curb quick irrational investment decisions, and should provide a pattern for how good returns are achieved.

Essentially, an investment strategy is a set of rules, procedures, and desired behaviors that dictate what investments to make and when.

An investment strategy largely depends on an investor’s character and abilities. These include access to capital, specialization in certain asset classes, risk tolerance, trading frequency, mastery of trading instruments, age, etc.

An investor without an investment strategy is considered a “sheep.” As well as this, every successful investor should be constantly improving their investment strategy.

To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework.

– from the book ‘The Intelligent Investor’

Investment strategy improvements should always reflect the acquisition of in-depth knowledge, new skills, and experiences. In the same way, changes in the macro environment also usually call for adjustments in the investing strategy.

At the end of the day, the market is a complex adaptive system, making outperformance hard to achieve in the long term without a good investment strategy.

An investment strategy consists of the few core variables described below. These variables are highly interdependent, but easy to understand.

We can start with how actively you want to be involved in your portfolio. As the name suggests, active investors are very actively involved in managing their portfolios. They take time to study specific investments and make changes to their portfolio frequently. Their goal is to beat the index.

It takes a lot of time, knowledge, skill, emotional regulation, and nerve to be an active investor. Active investors constantly monitor the market (and their heartbeat); and their trading frequency can be quite high. We can divide active investors into two groups:

Passive investment strategy, on the other hand, is based on buying and holding a well-diversified portfolio of investments. Most often, investments are made in index funds, ETFs or other types of investments that provide broad market diversification and low costs.

From time –to –time, investments in an individual stocks, crypto, or crowdfunding projects may be added, but most of the portfolio is about indexing and holding investments for the long-term.

The philosophy behind passive investment strategy is that being a successful investor is not about “timing the market”, but rather “time in the market”.

The holding period indicates how long a particular trading position is held. Passive investors usually hold their position for years, if not decades. As mentioned earlier, the idea is to diversify investments, hold them for the long term, and not worry about short-term volatility.

New positions are usually purchased on a monthly or quarterly basis using the so-called DCA (Dollar Cost Averaging) method. Short-term active investors or traders come in many types, including those who hold their positions for quarters and years, but the most common types of traders are:

It is also worth noting that being a short-term investor does not mean that you only hold short-term positions, as you can combine different holding periods. For example, you can invest half of your portfolio in long-term index funds and try to outperform the market with the other half.

One of the most important aspects of an investment strategy to consider is how risk-prone or risk-averse you are as an investor. This will determine which asset class you invest in and how large the allocation between the selected asset classes will be.

For example, a risk-averse investor might invest in gold, bonds, and sector ETFs, while a very aggressive investor might invest in stocks, cryptocurrencies, CFDs, or even options.

Risk tolerance should be rationally defined based on your income and net worth, age and retirement goals, desired returns, and how much volatility (risk) you can tolerate. There’s no point in investing if price swings make you anxious and your quality-of-life declines. To learn more about the risks of different asset classes, read our article on where and how to invest.

And if you are an active investor (and even more so if you’re short-term oriented), it’s important to have risk management in place. Risk management is about sizing up potential profits or losses, and parameters such as the maximum allocation per position, maximum loss per position, and so on.

Your risk management strategy should answer two fundamental questions:

The relationship between risk and reward is logically interdependent. For larger profits, you usually need to invest higher amounts in a single position with higher volatility. Technical analysis is often used to help determine the stop-loss position.

Liquidity is another important factor that determines the investment strategy you should take. Liquidity means how fast you can turn your investment back into money.

Depending on your potential cash needs in the future (for example, larger expenses such as a new car, flat, wedding, etc.), you need to allocate your investments wisely between liquid and less liquid investments.

Investments in the private market are considered less liquid than investments in the public market (stock exchanges). That said, there are stocks and other public investments that have low liquidity and are therefore harder to sell.

Having non-liquid investments and needing money fast can be considered one of the less-fortunate positions for an investor, as you will usually have to sell your investment at more of a discount if you find a buyer. As a wise investor, you want to make sure you have enough liquid investments for your short-term cashflow needs.

| Liquid investment examples: | Less liquid investment examples: |

|---|---|

| Popular stocks Popular index funds & ETFs Popular cryptocurrencies Gold and silver | Real estate Crowdfunding projects Less popular crypto projects VC/PE funds |

All of these factors lead us to the decision of which asset classes to invest your money in and to what extent. Most successful investors skillfully diversify between asset classes, and then additionally between subclasses or specifically-selected investments that they like best.

For example, you might:

These are all very different investment strategies.

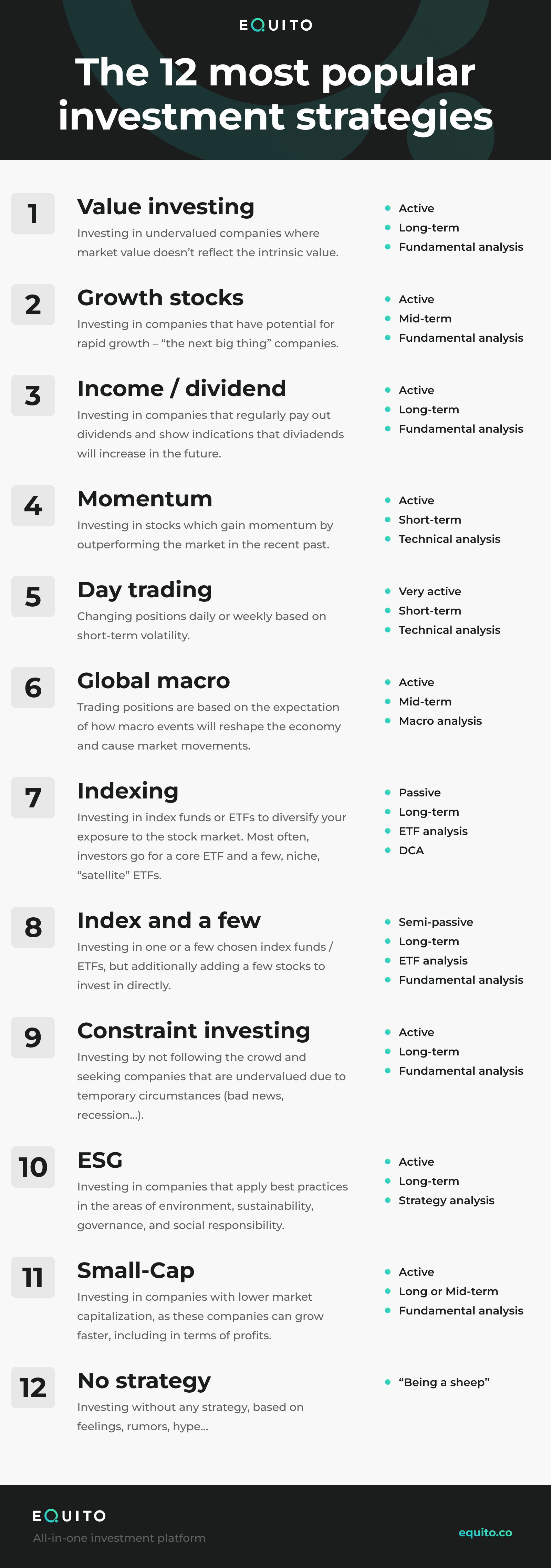

Within each asset class, we can find different investment strategies. Investing in stocks probably has the most defined investing strategies, since there’s a long history of stock investing with a broad selection of companies. Let’s take a look at some of the most popular stock investing strategies, and which strategy appeals to you the most.

Value investing is a long-term investment strategy, in which the goal is to find undervalued stocks. Value investors look for companies whose market value doesn’t reflect their intrinsic value. This means that the stock price should increase over the long term as the market recognizes the true value. The most famous value investor is Warren Buffet.

Value investors use fundamental analysis (where a company’s financial statements are taken into account) to determine the deviation of market value from the estimated intrinsic value. One of the biggest drawbacks is that undervalued, quality companies are hard to find.

You also need patience, because the growth of value stocks is usually slow, but stable. Value investing is clearly a long-term investment strategy.

Growth strategy focuses on companies that have the potential for rapid growth. These are the companies that are seen as “the next big thing,” (usually technology-based companies)

Growth investors are usually medium-term investors who are willing to take greater risks than value investors. It’s also worth noting that growth companies rarely pay out dividends.

When the market is growing, these stocks tend to grow much faster than value stocks. On the other hand, when the market is bearish, these stocks tend to fall faster than value stocks. Interest rates also have a big impact on growth companies.

An increase in interest rates usually causes the prices of growth stocks to fall, because investors are forced to use a higher discount rate for the future earnings they are forecasting for the growth companies. This means the valuations of these stock should be lower.

Dividend growth strategy focuses on companies that pay out dividends regularly and show indications that dividends will increase in the future. You can also find dividend-stock-focused ETFs.

Many investors who follow the dividend growth strategy tend to reinvest dividends for compounding purposes. It’s a strategy to follow if you want to build a solid passive income.

Momentum strategy is based on the past performance of a stock. The main idea is that stocks which performed better in the recent past (a few weeks to a few months) gain a certain momentum and could perform better in the near future compared to other stocks. In other words: winners tend to keep winning and losers keep losing.

It is a short-term investment strategy that requires an active investment approach. Investors who follow a momentum strategy typically use technical analysis to help them time the trading decisions. As a passive alternative, ETFs that follow momentum strategy can be a good choice.

The global macro strategy focuses on macroeconomic changes that occur at the global, national, or local level. Trading positions are based on the expectation of how macroeconomic events will reshape the economy and cause movements in the market due to systematic changes.

The global macro strategy usually takes into account various macroeconomic factors, such as economic growth, inflation, exchange rates, credit, international trade, (geo)politics and the like. As you have probably seen recently, the COVID -19 pandemic, the Russia-Ukraine war, and similar macroeconomic events have had a major impact on what happens in the stock market.

The other investment strategies mentioned above rely more on style factors, such as intrinsic value/market value, volatility, momentum, company size and quality, and carry.

Indexing is a long-term investment strategy in which you invest in an index fund or ETF to diversify your exposure to the stock market. Diversification can be geographic (global stocks, U.S. stocks, Asian stocks…), vertical (tech companies, pharmaceuticals, energy…), by company market capitalization (blue chips, smaller companies…), by market maturity (developed, emerging), and so on.

Many investors like to select a core ETF, and then some smaller satellite ETFs to further diversify their portfolios. For example, you might select a broad stock market ETF, and then add a tech, energy, pharmaceutical and developing market satellite. This strategy is called “core and satellites.” A list of ETFs with different diversification approaches can be found at justetf.com

Indexing is usually combined with long-term investing (buy and hold) and dollar cost averaging, which means you buy new stocks at the same frequency (every month, every quarter…) and then hold them for the long term, usually at least 10 years.

Since indexing can get a bit boring, many investors adapt their strategy to “index and a few”, i.e., they invest in the chosen index fund, but additionally choose a few stocks to invest in directly.

Contrarian investing strategy proposes investing against the market trend. It suggests buying when others are selling (in a bear market, in a recession, as an overreaction to news, etc.) and selling when others are buying.

The idea of a contrarian investment strategy is to find great investments by not following the crowd, and seeking companies undervalued because of temporary circumstances and mispricing. This strategy calls for a great degree of independent thinking and patience.

Let’s look at two examples: When a bear market causes stock prices to fall, you might buy companies at a price below their intrinsic value, and then sell them at a much higher price when the market recovers. In a similar way, a stock price can drop too sharply if there is an overreaction to bad news. It’s a risky strategy that takes a long time to pay off, assuming it is done properly.

The idea here is to focus on investing in companies that apply best practices in the areas of environment, sustainability, and social responsibility and can be a role model for other companies. The basic idea is that these companies will be more successful in the long term if they apply these practices.

The idea of this strategy is to invest in companies with lower market capitalization, as these companies can grow faster, including in terms of profits. Warren Buffet’s early strategy was to find undervalued small-cap companies.

Before we answer the question of how to select the optimal investment strategy, let’s recap the different investment strategies we know:

So, the last question is how to choose the best investment strategy. It all comes down to how actively involved in investing you want to be.

If you want to be a passive investor, the best option is probably:

If you want to be a little more active as an investor, let’s say semi-active, expand your strategy to “index and a few.” Learn how to analyze a stock, especially fundamental analysis, and allocate a small portion of your portfolio to handpicked companies.

As you learn to analyze stocks, determine whether you are more attracted to Value, Growth, or other types of companies. Learn as you invest, and constantly improve your strategy.

And if you want to be an active investor, there are two directions you can choose:

In both cases, you will want to fully understand the asset classes you are investing in, follow certain analytical principles for selecting the investments, and most importantly: have a risk management in place. Start with smaller amounts; read, test, learn and constantly improve your strategy. That’s how you become a winner in investing.