Extension of the investment services license

At Equito we have successfully extended our existing MiFID II license. The extended license allows us to offer asset management services, investment advice and publish investment research.

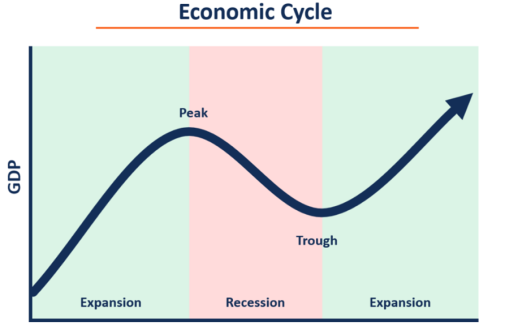

The business cycle (or economic cycle) describes periods of expansion and contraction in the economy. These cycles lead to widespread changes in economic activity, as measured by macroeconomic indicators such as GDP, employment, inflation, and others.

The business cycles are inevitable and have a huge impact on the economy and everyday life. Upswings in economic activity lead to a boom, and downturns to a recession.

The business cycle and macro indicators are also closely related to what happens in the stock market. In this blog post, we will look at the macroeconomics 101 that you need to understand as an investor.

Many things in business, life, and nature fluctuate, and the economy is no exception. For decades, the economy has gone from growth to recession, and back to growth, and then back to recession, and so on and so forth.

That’s what business cycles are: the constant ups and downs of the economy. We consider one business cycle to be complete after a single sequence of a boom and contraction.

The typical stages of each business cycle are:

Unfortunately, these movements bring many challenges, especially during major downturns. An economic downturn leads to a decline in economic activity and GDP, high unemployment rates, lower wages, and usually a collapse in the stock market.

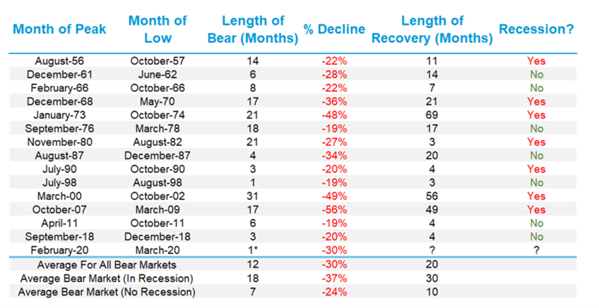

On average, the S&P 500 has fallen 29 % during recessions; not to mention the added psychological strain and morbid sentiment in the business environment.

The table below shows S&P 500 bear markets throughout history, including how long they lasted and if they were accompanied by a recession.

As you can see from the table below, bear markets can also occur when there’s no recession, but the length of the bear market is usually shorter than when a recession is present.

Here are two examples from history:

In 2008 we had one of the biggest financial crisis and recessions. The S&P 500 witnessed more than a 50 % decline, and it took 49 months to recover. The collapse of real-estate market not only caused a big collapse in the financial markets, but also a big recession in general.

In 2018 investors feared that the central bank would tighten the monetary policy, that the economy will slow down, and that the trade war between the U.S. and China would intensify, but things were not as bad as they seemed for investors. The S&P 500 declined by 20 %, but a recovery was made in a short 4 months, with no recession present.

Since business cycles have a great effect on individuals, businesses and investors, governments and central banks strive to measure the business cycle as accurately as possible and manage it with monetary and fiscal policies.

Here are two important facts regarding measuring business cycles:

The business cycles are measured mainly with GDP (gross domestic product), but there are other macroeconomic indicators that are also closely related to different business cycle stages.

For example, we know of lagging, leading and coincident indicators, and many of them are closely monitored by governments.

Here is the list of all the main macroeconomic indicators:

| Lagging indicators | Leading indicators | Coincident indicators |

| GDP (main indicator) Wages Unemployment rate Inflation Currency strength Corporate profits | Yield curve Stock market Currency movement Manufacturing activity Inventory levels Building permits Housing market New business formation Consumer durables | (Indicators which happen together with an event) Industrial production Retail sales |

As mentioned, business cycles can be influenced by governments and central banks. What governments tend to achieve with business cycle management is a stable economy, slow and steady inflation, and low unemployment rates.

The main tools that are at their disposal to help soften the rough ups and downs are:

| Fiscal policy | Monetary policy | Other |

| Government spending – Subsidies – Transfer payments – Welfare – Public work projects Tax rates – Income – Property – Sales – Investments | Interest rates Open market operations (buying and selling securities) | Macro expectations Forecasts and forward guidance |

Monitoring what stage of the business cycle we are at is very important for every investor.

As mentioned, business cycles impact a larger aspect of an economy (and possibly in a big way), not just a particular part of the population or a particular sector. That means business cycles also have a considerable overall influence on your portfolio movement.

In other words, the business cycle represents the systematic risk of your portfolio. Changes in the business cycle are closely connected to the whole stock market, which is a leading indicator.

In connection with business cycles, the stock market tends to rise (the so-called “bull market”) or fall (the so-called “bear market”).

On a practical level, this means you can’t fully avoid systematic volatility with diversification. As the saying goes: a rising tide lifts all boats, and on the other hand the vast majority of investors take a hit during a recession.

The purpose of monitoring business cycles is not to panic when a downturn happens, but rather to understand what is happening and, if possible, to take advantage of a downturn when stocks are cheap.

To be honest, it’s quite hard to turn uncertain and drastic market changes to your advantage (when everyone is panicking), nevertheless, understanding what’s happening on the macro level and how business cycles work might help you make more rational investment decisions and adjust your investment strategy based on where we are at in the business cycle.

It’s also worth noting that even though business cycles impact the economy in general, some sectors are more exposed than others under new economic conditions, and some sectors even become winners during these new market conditions.

A very successful investor, Howard Marks has a great recommendation when it comes to business cycles, macroeconomic indicators, and investing.

His recommendation is to view the world as behaving cyclically and oscillating, rather than going in some straight line. Here are his thoughts:

Almost everything is cyclical. For example, the economy expands and contracts; consumer spending waxes and wanes; corporate profitability rises and falls; the availability of credit eases and tightens; asset valuations soar and sink. Instead of continuing unabated in one direction, all of these phenomena eventually reverse course. It’s like the swinging of a pendulum from one extreme to the other.

Source: Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life

You can read our review of the book Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life here. You might be also interested in the best investing books of all time.

Macroeconomic indicators describe the overall health of economy and where we are in the business cycle. As mentioned, the business cycle has real consequences for the everyday life of the greater population.

That’s why macroeconomic indicators and business cycle stages are extensively studied in the field of macroeconomics and regularly tracked by governments, professional advisory or financial firms, and others.

As an investor tracking the stage of the business cycle we are at, it’s wise to know and keep an eye on the main macroeconomic indicators.

Based on what’s happening in the business cycle, there are at least three things you can do:

Now we’ll look more closely at a few macroeconomic indicators that you should know and monitor as an investor, with the goal of assessing what stage of the business cycle we are at, and how these indicators influence the stock market in general.

| Economic indicator | Type of an indicator | |

| 1 | Interest rates | Lagging / Monetary policy |

| 2 | GDP | Lagging |

| 3 | Inflation | Lagging |

| 4 | Unemployment | Lagging |

| 5 | PMI | Leading |

| 6 | Retail sales | Coincident |

| 7 | Industrial production | Coincident |

| 8 | Corporate profits | Leading |

Interest rates are one of the main tools governments and central banks use to influence business cycles with monetary policy.

Businesses and consumers finance part of their spending and investments with loans, and lower interest rates mean more investments and spending (more, cheaper money available), which leads to economic growth, but can also lead to an unhealthy inflation rate. That means that lower interest rates have a positive effect on the stock market.

On the other hand, high interest rates have negative influence on stock market. High interest rates lead to restrictions in borrowing money, monthly interest payments increase, and all that usually means slower growth of businesses.

The stock prices of companies that use high leverage (such as many growth stocks) can be hit especially hard during interest rate hikes.

In a similar way, consumers can have a harder time financing their investments (real estate, bigger purchases …) and increases in their monthly mortgage payments can limit their purchasing power.

An additional tip: When studying interest rates, pay special attention to The Inverted Yield Curve (a leading indicator) which is one of potential signs of coming recession.

And where can you monitor interest rates? Here’s the best site: Trading Economics – Interest rate

| Monetary policy | Stock market influence |

| High interest rates | Negative |

| Low interest rates | Positive |

Gross Domestic Product (GDP) is the main indicator of the business cycle movement, and measures the market value of all finished goods and services produced over a given time period.

GDP shows the overall size of a specific economy (on the national level) and consists of consumption, investments, government expenditure, and net exports. When it comes to GDP, there are at least two factors to consider:

Governments usually release GDP each quarter for the yearly level, with annualized data.

And where can you monitor GDP and economic growth? Here’s the best site: The World Bank Data GDP Growth (annual %).

So how does GDP influence the stock market? In general, we can say that a higher GDP growth number has a positive impact on stock markets, since that also means higher spending and more investments, and consequently the growth of businesses.

The bull run on stock markets can also cause GDP growth because of more wealth and confidence among businesses and the population.

| Economic indicator | Stock market influence |

| GDP growth | Positive |

| GDP decline | Negative |

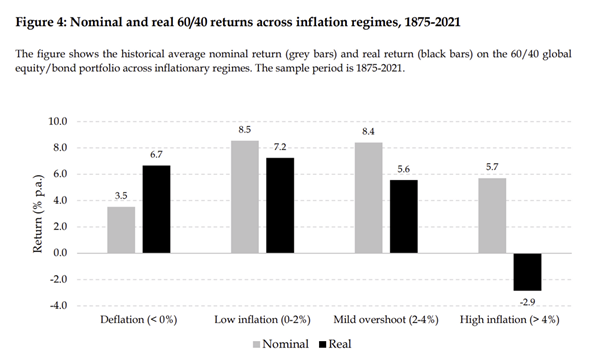

Inflation tells us how the average prices of goods and services increase over time, and how money loses purchasing power. It’s a consensus among macroeconomists that moderate inflation is healthy (around 2 % or a bit below). Higher inflation than that has a big influence on purchasing power.

Deflation, on the other hand, is a sign of a weakening economy, since falling prices usually mean lower consumer spending. Falling prices can lead to slower production, which can lead to lower wages, or even layoffs. Historical performance shows that the stock market and inflation have an inverse relationship.

That means that most often (but not as a rule) higher inflation lowers purchasing power and thus leads to poorer inflow of new money on the stock market. That also means stocks are not necessarily always a good protection against inflation.

An additional tip: We are also aware of so-called Stagflation. This is a combination of stagnation (no GDP growth) and inflation. Stagflation describes an economy with high inflation, high unemployment, and negative, little, or no growth in GDP.

In the US, inflation is measured with the Consumer Price Index. Other countries have similar indexes to monitor inflation. And where can you monitor inflation? Here’s the best site: Trading Economics – Inflation Rate.

| Economic indicator | Stock market influence |

| High inflation | Negative |

| Healthy inflation | Positive |

| Deflation | Negative |

The unemployment level shows the percentage of labor force that is unemployed. It’s tracked on a monthly basis by almost all countries and it’s one of the indicators of how strong the economy is.

In addition to the unemployment rate, the hiring rate is also important, and indicates how many new jobs are created. The availability of good jobs and personal income growth opportunities are extremely important for a healthy economy.

If the job creation and personal income outlook is positive, that means more money is available for retail, which leads to more spending and investments, which leads to higher corporate profits and more capital becoming available. The general sentiment is positive, which leads to more courage when it comes to investing.

On the other hand, when people are losing jobs or are hit by a decrease in their income, they tend to invest less or even redeem investments they already have, which causes issues in the stock market. A 4% to 5% unemployment rate is considered to be healthy, as that is the natural unemployment rate at which inflation is still stable.

Want to know where to monitor unemployment? Here’s the best site: Trading economies – Unemployment rate

| Economic indicator | Stock market influence |

| High unemployment | Negative |

| Low unemployment | Positive |

Other indicators worth mentioning:

This is an index focused on the US markets, and based on a survey sent to businesses in all industries.

The PMI is used to measure and forecast overall business confidence, based on data on planned production levels, incoming orders, inventories, employment, etc. The index is highly correlated with GDP.

A major part of spending is related to retail sales to consumers. In the US, two-thirds of GDP is based on consumer spending, and that’s why governments often track retail sales.

If retail sales are growing, this can be an indicator of a healthy, growing economy. A decline in retail sales can be a sign of an economic downturn. Logically, stock markets can react negatively when retail sales face a decline.

Similarly to retail sales, industrial output is often measured to track the outputs in production industries such as the manufacturing, electric, mining, and gas industries. Industrial production shows the capacity, capacity utilization, and sustainability of production levels.

In particular, capacity utilization can be an important indicator of demand strength or weakness. When it comes to industrial production, it’s important that it’s not under- or over-utilized, since both scenarios can negatively influence the stock market.

In the US, the index is called the Industrial Production Index or IPO.

And last but not least, let’s mention corporate profits. Higher corporate profits show that businesses are growing with healthy profit margins.

That can also mean more dividends for investors and additional capital for investments. Thus, corporate profits usually have a positive influence on stock market growth. On the other hand, declining corporate profits can be a sign of trouble for future economic growth.

The state of the business cycle in H1 2022:

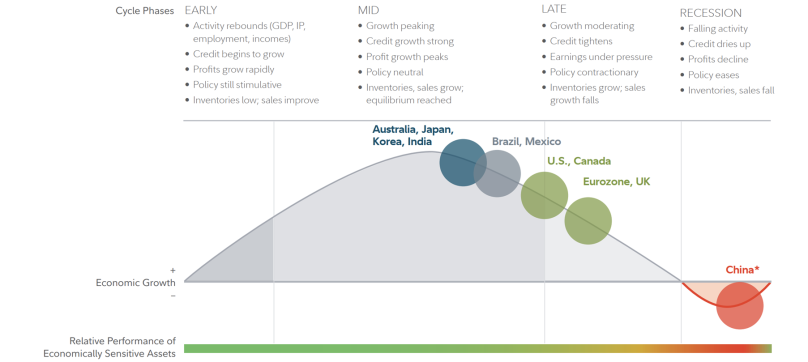

Monitoring macroeconomic indicators can help you understand in which directions markets are headed and in what phase of the cycle we are in.

Through understanding business cycles and macro indicators you can adjust your portfolio, spending, and professional goals accordingly.

Last but not least, if you are wondering where are we currently in the business cycle, Fidelity has posted a nice graphical representation.