Extension of the investment services license

At Equito we have successfully extended our existing MiFID II license. The extended license allows us to offer asset management services, investment advice and publish investment research.

When you start diving in the world in investing, sooner or later you stumble upon the terms like primary and secondary market, public and private market, bond and equity market, and similar.

In this blog post we’ll look at the difference between the primary and secondary market.

The primary market refers to an event where an organization offers securities to the public for the first time and thus new securities are issued (created).

This event is called the Initial Public Offering (IPO) or Follow-on Public Offering (FPO). This is how companies, governments and other organizations can raise money by offering new equity and debt securities.

When a company decides to go public (i.e., perform an IPO), they most often hire an investment bank, create fundraising materials and execute a roadshow among institutional investors with the goal of selling them newly issued securities.

Sometimes small retail investors can also participate through their brokers. The investment bank is responsible for supporting and underwriting the IPO, and that is why the primary market is where securities are created.

The buyers in this case purchase the securities directly from the issuer. Securities that are offered for the first time are most often available at a fixed price, set by the issuer in line with investment bankers’ advice.

The secondary market is where securities are traded, rather than created, and after securities have been offered to the market for the first time, they can be traded (and most often are) on the secondary market.

The secondary markets are:

The OTC type of the market, also called a dealer market, is for securities that are not listed on the stock exchanges and are therefore traded between participants directly.

On the secondary market, the price of the security never stays constant and is subject to supply and demand. Buying and selling takes place among investors themselves.

The purpose of the secondary market is to provide liquidity for investors, not for organizations to raise fresh capital.

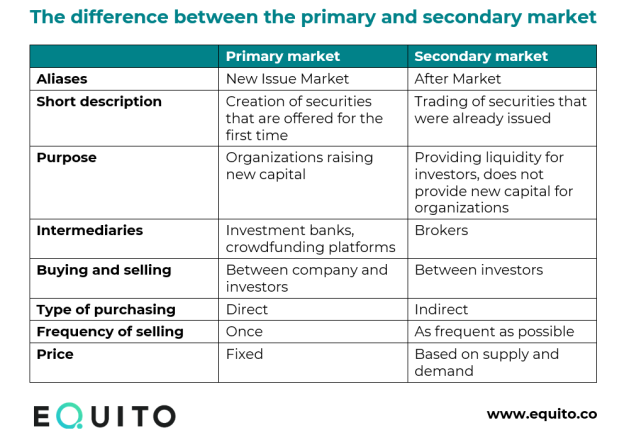

In the table below we have prepared a comparison of the primary and secondary market: