Extension of the investment services license

At Equito we have successfully extended our existing MiFID II license. The extended license allows us to offer asset management services, investment advice and publish investment research.

When you start diving into the world of investing, sooner or later you stumble upon the terms like primary and secondary market, public and private market, bond and equity market and similar.

In this blog post we’ll look at the difference between the private and public market.

Public companies are listed on stock exchanges and can be traded by the general public, institutional, or retail investors. For example, you can open an online brokerage account and simply buy a share of a publicly traded company such as Apple, Tesla, Microsoft and others.

Examples of stock exchanges are:

The public market, meaning all the companies publicly listed on stock exchanges, are regulated by the Securities and Exchange Commission (or other securities regulators), meaning they must meet certain financial, reporting, and other standards.

This provides certain legal protection for investors. It also means it’s easy to find information about publicly listed companies. The liquidity of most publicly listed companies is high, but so is price volatility.

The crypto asset-class and cryptocurrency exchanges also shares some characteristics of the public market, although is not nearly as much regulated as stocks and bonds are.

The private market is not as heavily regulated and organized. Deals are made on a more or less individual basis, or with the help of intermediaries (brokers, agencies, investor networks etc.), but are not available to the general public.

Venture capital, private equity investing, acquisitions, real estate etc., all fall under the private market. Since the companies are not listed, liquidity and perceived volatility are much lower.

That means it’s much harder to buy or sell shares, and the price is not determined in real time on an exchange, but through valuation of the company or with new funding rounds.

Private companies usually don’t have to publicly report on their financial performance (reporting of private companies differs from country to country), so it’s also much harder to find information on them.

A company goes from being private to being publicly listed one through a process called an Initial Public Offering (IPO).

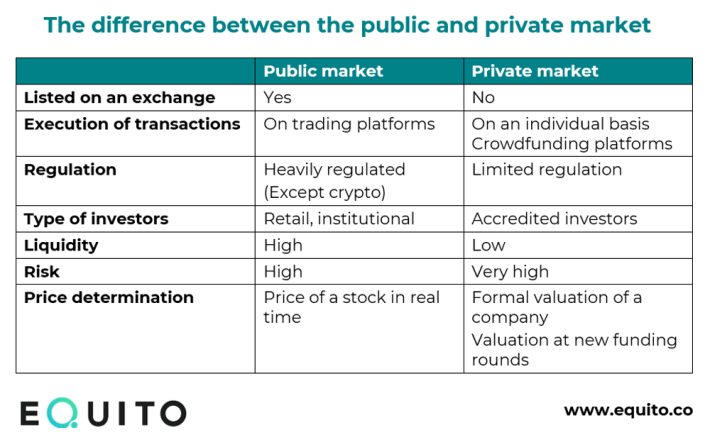

In the table below we have prepared a comparison of the public and private market:

Equito is an all-in-one investment platform that offers you a way to invest in companies in the public and private market. Consequently, you can reach an additional level of diversification among different asset-classes and potentially gain a better ROI on your portfolio.